A bank is a financial institution that accepts deposits from customers. And also lends money to the people at interest rates. In some countries, the customers will also get interest money for the money or funds they have in their bank account. And in some other countries, the account holders have to pay some fees for the bank to maintain their account.

In this guide, we will discuss how the banks work, what are the types, and also what are the functions of the banks. We can see multiple banks that are operating in every country globally. There is enough amount of competition which is good for any industry. And when there is competition the ultimate winner will be the customer or the people in general.

How does Bank work?

The primary function of the bank is to accept and lend money. Here whenever you open an account and deposit your money into the account. The bank will pay you some money as interest on your deposits. The same money which you had deposited will be lent by the bank to some other person. The person who has taken the money as a loan has to pay interest on the loan.

Here you should understand this equation.

Interest Paid by the Banks on Deposits to the Customers < Interest Paid by the People on Loans

So here the basic business model used by the bank is very clear. They take money as a deposit in your account. The same money will be given to others as loans.

The interest rate that is paid to the depositor of the money is very less when compared to that which is paid by the one who has taken the loan.

So the bank is just taking your money and lending the same money to other people at a higher rate of interest. It is as simple as that. But there is huge systematically designed machinery that is required to keep your deposit safe.

How Banks Make Money?

Now we know how they work, but you should also know about the ways in which they make money. Keep in mind that loans are not the only way that is used by the banks to make money. There are other ways too, let me explain to you all of them one by one.

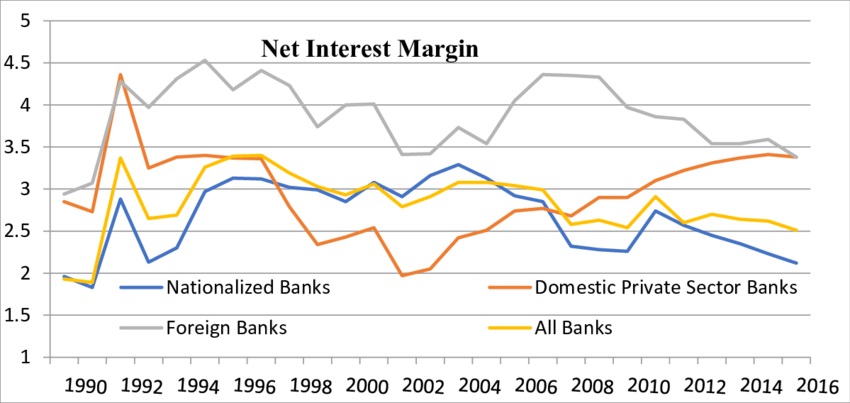

1. Net Interest Margin

There is a margin between the interest that is paid to the deposits and the interest that is taken by the loan takers. And you should know that this margin is high enough for the banks to pay all their expenses, employee salaries and also to make a huge amount of profits.

2. Exchange Rates

Whenever you want to get a foreign currency card or want to buy foreign currency. You might have noticed that there will be a difference between the buying and selling price of the currency. Let me explain this to you with an example, have a look at the image below. This shows a currency exchange rate board.

Now have a look at the exchange rate of the Canadian Dollar. (CAD) The price at which you can buy 1 CAD is 4.139 and the price at which you can sell the same to the bank is 3.810.

So there is a margin between the exchange rates. To be specific 4.139 – 3.810 = 0.329. The bank will earn a margin of 0.329 on every Canadian dollar.

3. Investment Options for Customers

Now the banks have come a long way and they are offering investment opportunities for their customers. You can now invest in stocks using your demat account and also in mutual funds. But when you use your account to invest in stocks, mutual funds, bonds, commodities you will be charged a fess.

4. Fees Paid by the Customers

As a customer, you will be paying a lot of fees to your bank. Some of the examples are listed below.

- Annual maintenance charges of your debit and credit cards.

- ATM network usage fees.

- Online banking fees.

- Branch service fees.

- Overdraft fees.

- Late payment fees.

- And late payment fees.

Types of Banks

There are various types, I have listed all of them below.

- Central Banks.

- Commercial Banks.

- Retail Banks.

- Shadow Banks.

- Regional Banks.

- Investment Banks.

- Cooperative Banks.

- Credit Unions.

- Savings and Loan Associations.

Functions of Banks

- Accepting Deposits. (Savings Deposits, Fixed Deposits, Current Deposits, Recurring Deposits)

- Granting Loans. (Overdrafts, Credit Cards, Loans, Discounting Bills of Exchange)

- Agency Functions. (Transfer of Funds, Periodic Payments, Periodic Collections, Cheques Management)

- Utility Functions. (Issuing Letter of Credit, Travelers Cheque)

Cost of Running a Bank

There is a requirement for a huge investment of money as well as manpower to successfully run a bank. Let me tell you a few places where the cost increases. The major place where the banks spend money is to maintain the branches and pay salaries of the bank officials.

These are not the only 2 things, there are many other places where they need to spend the money. I have listed a few of them below.

- Maintaining the critical systems of money management.

- Safety of the customer data.

- Marketing the banking products.

- Staffing Customer Care Centers.

- Printing documents like passbook and checkbooks.

- Running the ATM network.

- Developing and maintaining mobile banking applications.

- Running the online banking system safely.

- Maintaining the online presence using the official website and social media promotions.

Conclusion

This is what a bank is and a lot of other information you should have about it. Every one of us needs a bank account to survive in this world for one or other reasons. And in cases, we also need to have an alternative bank account. But when you are choosing the bank to open the account you should be very careful. Ask these questions to the bank before you open the account. And you have a question of where are banks near me? then find them here.

- https://en.wikipedia.org/wiki/Bank

- https://money.howstuffworks.com/personal-finance/banking/bank1.htm

- https://www.imf.org/external/pubs/ft/fandd/2012/03/basics.htm

- https://byjus.com/govt-exams/functions-of-bank/

- https://smartasset.com/checking-account/types-of-banks